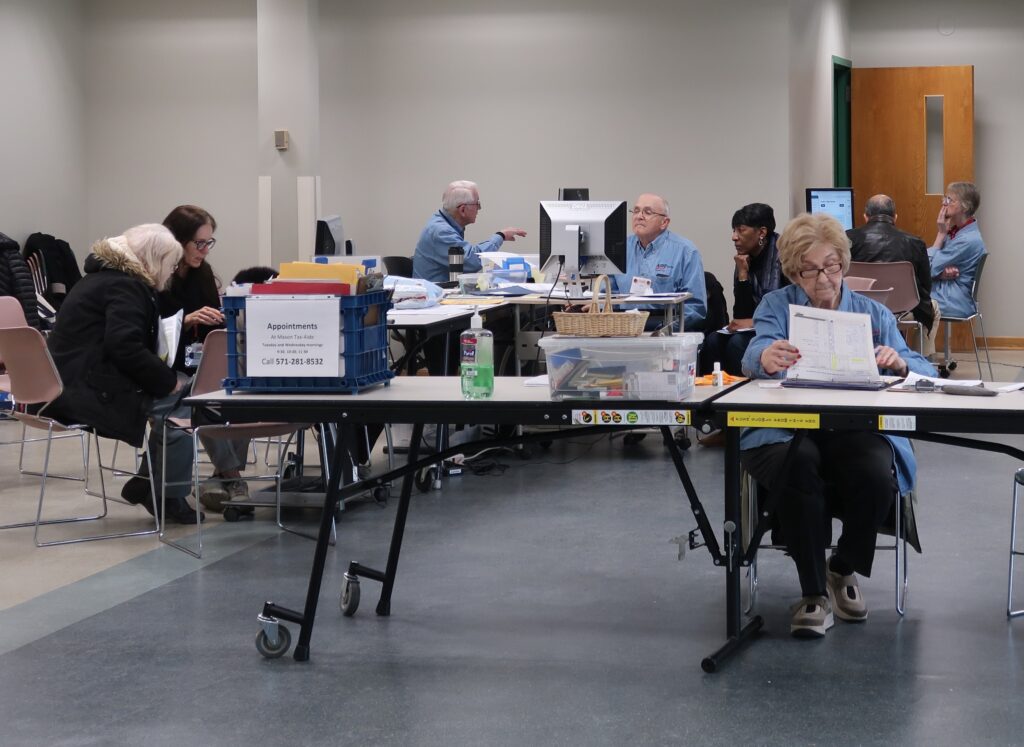

AARP volunteers help residents file taxes

The AARP Foundation Tax-Aide program starts this week.

AARP volunteers will provide free federal tax return preparation and e-filing at 11 locations in Northern Virginia, including the Mason Government Center and the James Lee Community Center.

Although everyone is welcome to take advantage of this service, Tax-Aide clients are generally low and middle-income seniors, the AARP Foundation states. Clients do not have to be members of AARP.

The Tax-Aide volunteers, are certified by the IRS. They work with taxpayers to help them get all the deductions and credits for which they qualify.

The Tax-Aide program will be at the Mason District Government Center on Columbia Pike Jan. 30 through April 15. The service is available 1-8 p.m. on Mondays and Thursdays; 9:30 a.m.-1 p.m. on Tuesdays, Wednesdays, and Fridays; and 9 a.m.-1 p.m. on Saturdays. The center is closed on Feb. 17.

Walk-ins are welcome and appointments are available at this site. Call 703-249-9961 to make an appointment.

The AARP Foundation urges taxpayers to pick up an intake packet at the Mason Government Center or download an intake form and Form 13614C before making an appointment.

Tax-Aide volunteers will be at the James Lee Community Center on Annandale Road in Falls Church Feb. 1-April 15. Tax preparers will be on hand for walk-ins Tuesdays-Thursdays, 1:30-4:30 p.m. This site doesn’t take appointments.

Taxpayers need to bring the following documents: a photo ID; Social Security cards for themselves and dependents; a copy of last year’s tax return; W-2s; Social Security benefit statements; 1099 interest, dividend, pension, and IRA statements; brokers’ statements; K-1s; W-2Gs for gambling winnings; and other relevant paperwork.

Self-employed individuals should bring information about the earnings and expenses of their business.

Taxpayers who itemize deductions should bring documents and records concerning outlays such as mortgage interest, real estate tax, personal property tax, medical expenses, and charitable contributions. Those claiming education credits should bring Form 1098-T from the relevant school and records of outlays for tuition and other qualifying expenditures such as course books.

Direct deposit of refunds and direct debit of taxes owed require the bank routing number and the taxpayer’s account number.