Mason District residents complain about rising assessments at budget town hall

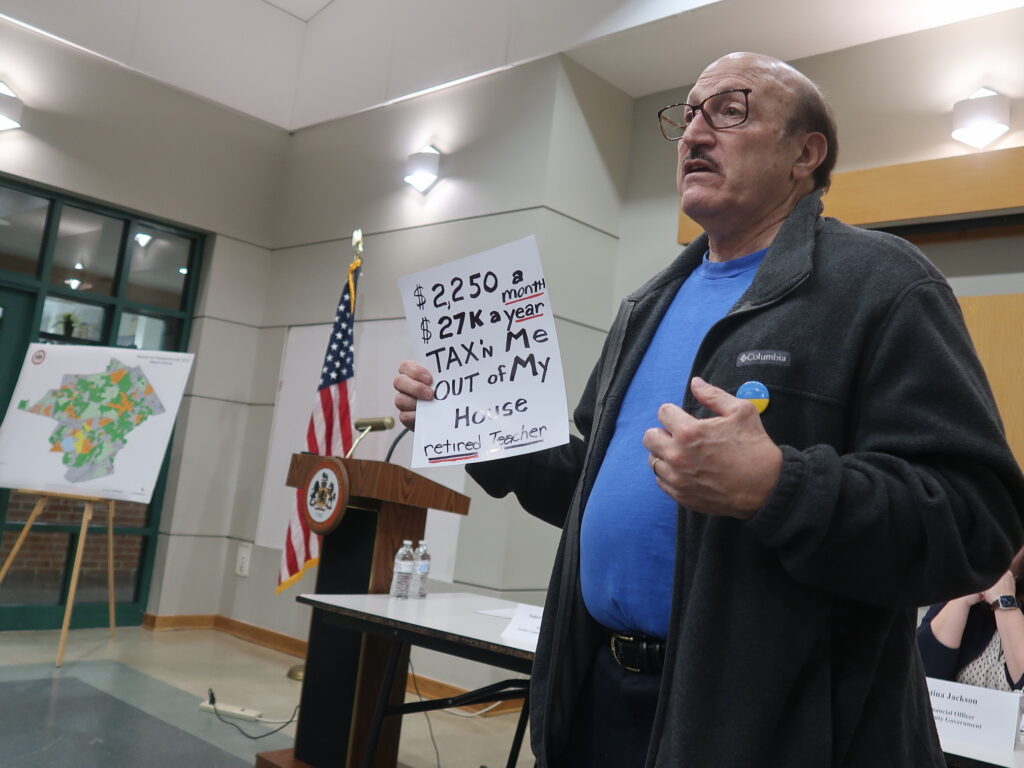

Mason District residents complained about soaring real estate assessments at Mason Supervisor Penny Gross’ Budget Town Hall on March 9.

While the county’s budget proposal for FY 2024 says the average property tax bill would increase by about $520 from last year, some Mason residents are seeing an increase of $1,000 or more.

Real estate assessments for 2024 are up an average 6.34 percent in Mason District, slightly below the countywide average of 6.79 percent.

To help compensate for the rising assessments, Gross said she would support reducing the tax rate by at least 3 cents.

The draft $5 billion budget for FY 2024 proposed by Fairfax County Executive Bryan Hill would retain the current property tax rate of $1.11 per $100 of assessed value.

Related story: Real estate assessments rise again

One person at the meeting said his tax bill has gone up 24 percent in the past four years, due to rising assessments. Someone else cited a 45 percent increase, while another resident said his assessment is up $1,000.

People also complained the tax increases are driving seniors and working-class families out of the county.

Because of restrictions imposed by the General Assembly, Virginia counties can’t raise revenue through an income tax, Gross said, so they have to rely on property taxes. The proposed 2024 budget projects $4.4 billion in property tax revenue.

While rising assessments reflect a strong economy and rising property values, that doesn’t help taxpayers.

People who aren’t selling their homes don’t benefit from rising values, one resident noted. And if the burden were shifted to income taxes, that would still be a tax increase.

Related story: Fairfax County supervisors consider giving themselves a big pay raise

Jay Doshi, director of the Fairfax County Department of Tax Administration, explained that the assessments are done independently and are based on the sale prices of comparable homes in the neighborhood. State law requires annual assessments.

Doshi urged people who think there are mistakes in their assessment to file an appeal. The deadline to appeal an assessment is April 3. He also noted the Board of Supervisors in December 2021 expanded tax relief for seniors and people with disabilities.

In response to a comment that the county should set a cap on assessment increases, Gross said “we don’t have the legal authority to set a cap, which is why we have to reduce the tax rate.”

Several people called for cutting spending and making the government more efficient.

The challenge for the Board of Supervisors, Gross said, is to figure out a tax rate that would still support the level of county services people want.

“We have pressure on both sides. We’re trying to strike a balance,” said Fairfax County Chief Financial Officer Christina Jackson. Whenever cuts are proposed, advocates for those programs argue for more money.

Related story: County executive proposes a $5 billion budget for FY 2024

If property taxes were to be substantially reduced, Gross asked the audience what county services they would cut. No one had a realistic response.

Several people, however, complained about the motion passed at the board’s March 7 meeting to consider raising supervisors’ salaries by as much as 37 percent – and 45 percent for the chair.

That is not a done deal, Gross clarified; “What we did was advertise a public hearing.” That will happen on March 21.

Gross said that during her 28 years on the board, there have only been three salary increases. Due to restrictions imposed by the state, supervisor salaries can only be raised during a limited time period/ If approved, the increase would take effect for new board members elected in November.

The big pay increase discussed for supervisors was especially jarring as the proposed budget includes a 2 percent market rate adjustment in employee salaries.

Jackson noted, however, that there would also be performance, merit, and longevity increases, resulting in an average increase of 4.06 percent for non-uniformed employees and 4.39 percent for uniformed employees.

More than half (52.5 percent) of the proposed $5 billion county budget would go to Fairfax County Public Schools, and $109.3 million would support employee compensation. Another $45 million would go to enhanced tax relief, and additional funds would offset inflation and support new facilities and other priorities. That would leave $90.2 million for the board’s discretion, Jackson said.

The Board of Supervisors will hold public hearings on the budget on April 11-13.

The important date for board action will be May 2, when the supervisors mark up the budget, Jackson said. The board’s adoption of a final budget, scheduled for May 9, will be a formality.

Same old story, same old excuses. Us poor BoS are restrained by the State General Assembly and County Attorneys and we can’t do anything! How lame is that? That is why the entire BoS and its governing protocols needs to be debunked. They are useless bunch.

Seniors are being crushed and cant apply for property tax relief because the County caps seniors assets at $400K, exclusive of their primary residence. Hello, have the BoS ever taken an economics class? 401K/Retirement Plans needs to support retirees for close to 30 years after retiring. The threshold for property tax relief is set at $400K. This needs to be raised to $1M to maintain financial solvency for seniors in an uncertain economic climate. Seniors are on fixed incomes and must budget their limited funds to survive, something that the BoS does not seem to understand or be able to do. Wouldn’t it be nice if seniors could simply say, we need more funds, so give it to us or else! The BoS is holding a gun to the heads of those who are struggling to maintain economic solvency for the rest of their lives.

Most 401s are dependent on the financial markets that have been in a bear market since the spring of 2022 because of post pandemic COVID, rising inflation and uncertainty. In essence, the County is forcing its long standing residents to either move or cut their budgets on food, heat, power, healthcare and other necessary needs to feed the BoS property tax monster………shame on the BoS for doing harm to its senior citizens and chipping away at what could be their best years in this County.

While the plight of the truly needy retired and elderly being priced out of their communities and neighborhoods is a REAL issue that deserves attention, it’s tough to feel too much compassion and understanding when the individual holding up the sign at the Budget Town Hall is paying over $2K per month in RE taxes. But that’s the price you pay when you live in a SF waterfront home on a 1+ acre plot of land in Lake Barcroft assessed at over $2.1M, I suppose.

In answer to Penny’s question about what program to cut? Let’s start with cutting the BoS salary. It may only be symbolic – but that’s what leaders do. They don’t ask the community to sacrifice while giving themselves a pay raise. Does any member of the local TV news outlets see the outrageous hypocrisy!!!?

Just because someone wants something or some service doesn’t mean the government should provide it. Heck Fairfax put a 5 cent tax on plastic bags for environmental wants. The county government barely covers sanitary trash and even the private sector is screwing that up due to rules regulations and inadequate landfill / dump availability. The job of elected leaders in a republican for of government is to make hard decisions. When all the BoS does is tax and spend for everything & everyone’s wants it’s always going to be a mess and someone else’s fault because those elected are avoiding the hard decisions.

Why do people with no children pay tax for schools? Let them donate if they have the desire and the means – many would. Also dog parks aren’t really used by dog owners anymore. Mason park people just let their dogs off leash wherever they want in the park. Dog owners let their dogs run at Green Springs. So dog parks can be cut. Dumping violators are not fined … so whoever is supposed to do that can be cut. Zoning regs for sfh packed with 20 people in residential area aren’t enforced – those jobs can be cut. Parks don’t bother to do due diligence on dredge quote for Accotink – so that entire group can be cut… oh and in the meantime give BoS a raise!?? And raise taxes?! No. Get sh-t done and done correctly, focus on the basics, be a leader. Take your lumps BoS. It’s just part of being a public servant –

Being a county supervisor is a full time job. Anyone exercising that degree of responsibility should be earning more than $95k per annum. The BOS currently consists of 10 members. Each of those members could receive a 20% pay raise simply by redirecting the $200k per annum that they keep voting to gift to the Capital Area Immigrants’ Rights Coalition. This appropriation goes to pay for the legal expenses of immigrants who are litigating removal cases in the federal courts. These cases have nothing to do with the county or its residents. So, if the BOS wants to virtue signal, I recommend that its members individually contribute a portion of their pending pay increases to this program.

I am a senior home owner who will see my property taxes go up to $15,000 plus dollars. I do not have waterfront property etc and live on a very busy road. I am not eligible for any tax relief because I have savings over the selected amount, to cover any future medical issues as I age. I am stuck because I don’t plan on becoming dependent on family or welfare.

Without knowing the details of your circumstance other than what I can glean from Ffx Co’s Real Estate Assessment database, when a Ffx Co resident purchases their home 18+ yrs ago for over $1M, well, there’s probably lots of county folks without your potential means who likely need the help first. Ffx Co says your residence, as a 6700 sq ft 6BR2.5+BA house, is worth over $1.3M today. I did the math; your RE taxes and refuse fee has increased at a 2.4% annual compounded clip since your purchase. That does not seem unreasonable to me. Perhaps a refinance, reverse mortgage or HELOC would provide cash flow for tax payments? Can you rent out a basement bedroom, maybe?

I empathize with Ffx Co homeowner seniors with limited means whose real estate tax burden is seriously jeopardizing their ability to pay for groceries, medical needs, and basic living necessities. These are the folks that need County programs in place to provide some relief for their plight. I’d absolutely support increasing the non-RE net asset limit for assistance under Ffx Co’s Tax Relief Program – $400K is too little in this day and age. Maybe some type of homestead exemption program should be instituted, if allowed, in Virginia.

Fact is, RE taxation is about the only substantive means for Virginia’s counties and cities to fund themselves. IMO, taxing assets such as one’s house or car is less fair and appropriate than taxing income, but that’s a bigger issue to resolve through Richmond and/or our State Constitution. Good luck with that.

Oh wow, you indirectly doxxed her and told her to take a heloc; aren’t you just a gem of a human being?!

Oh, please, spare me your sanctimony. She used her own name in her post; it took all of 30 seconds using the very public Ffx Co RE database to to find out her info. BTW – doxxing suggests malicious intent, and there’s absolutely nothing malicious about what I posted. Her self-identification was the only personalization I see here. I added nothing of any substance to her public ID.

Re-read her post – she said she “was stuck”, ostensibly because she was not eligible for County tax relief to mitigate her tax burden. My response to her only offered options, one of which was a HELOC. I certainly DID NOT tell her to apply for one.

I’ve been paying Ffx Co RE taxes for over 30 yrs. I don’t particularly want my tax dollars going to support the comparatively well-off 1% when there are truly deserving Ffx Co citizens that need support programs. I would hope you feel the same.

Here is an idea for you. If you are sitting on a property worth more than a million dollars (likely all equity) and can’t afford the taxes. Sell the home and move to a cheaper part of the country. People do that all the time. I grow up in California and my parents quickly moved to Nevada when they retired.

The other thing is that a large portion of these seniors likely bought the property back when red lining and other discriminating policy were rampant. I have very little sympathy for millionaires complaining that they are too rich for tax relief.

I see, she is racist for her opinion that her taxes are too high. Apparently she didn’t earn what she has now, so she just give it up and move away. You, Joe, are a wonderful carrier of THE MESSAGE.

I am getting secondhand embarrassment for that man holding up a sign declaring that his house is worth millions and that he cannot afford to live there. Do these people not have any sense of shame or self awareness?

No sympathy for millionaires who are too rich for tax relief is right.

See, you work, save, and sacrifice for 10-20 years, put all your savings toward a down payment on a house, and in 20-30 years it’s worth 1M or more and is your most significant investment. By the time you’re retired, you’re living off retirement and social security, so increased taxes are significant even if you have a 1M+ house that you’ve lived in for decades. Don’t hate on the American Dream because you didn’t have the fortitude, guts, or smarts to do what that retired teacher did. Owning a 1M+ house in this area doesn’t make you rich. It means your children will inherent something, and you probably live like a poor person, don’t spend money on anything, and shop for clothes at thrift stores once or twice a year. Ask me how I know.

Yes. Let’s just keep raising taxes to support their government pensions. If you sell your house they love to take half in more taxes. It’s an endless cycle. They just need to stop hiring and spending money they don’t have.

The cost of living increases for the all the pensions in Fairfax need that tax revenue lol. There is no way out…. Complaining goes on deaf ears here

There is no need to cut any programs to save money. There IS a need though to dig into those programs and become more fiscally responsible with the taxpayer’s money. I work for the County and have done so for 30 years now, and in my agency alone I could save the taxpayer over $2,000,000.00 within a year just through restructuring and one or two one-time expenditures. And it could be done with no loss of service to the citizens.

$2 million out of a proposed $5 BILLION budget? Unless you assume similar reductions may be found in EVERY OTHER County agency….well, do the math.