Tag: taxes

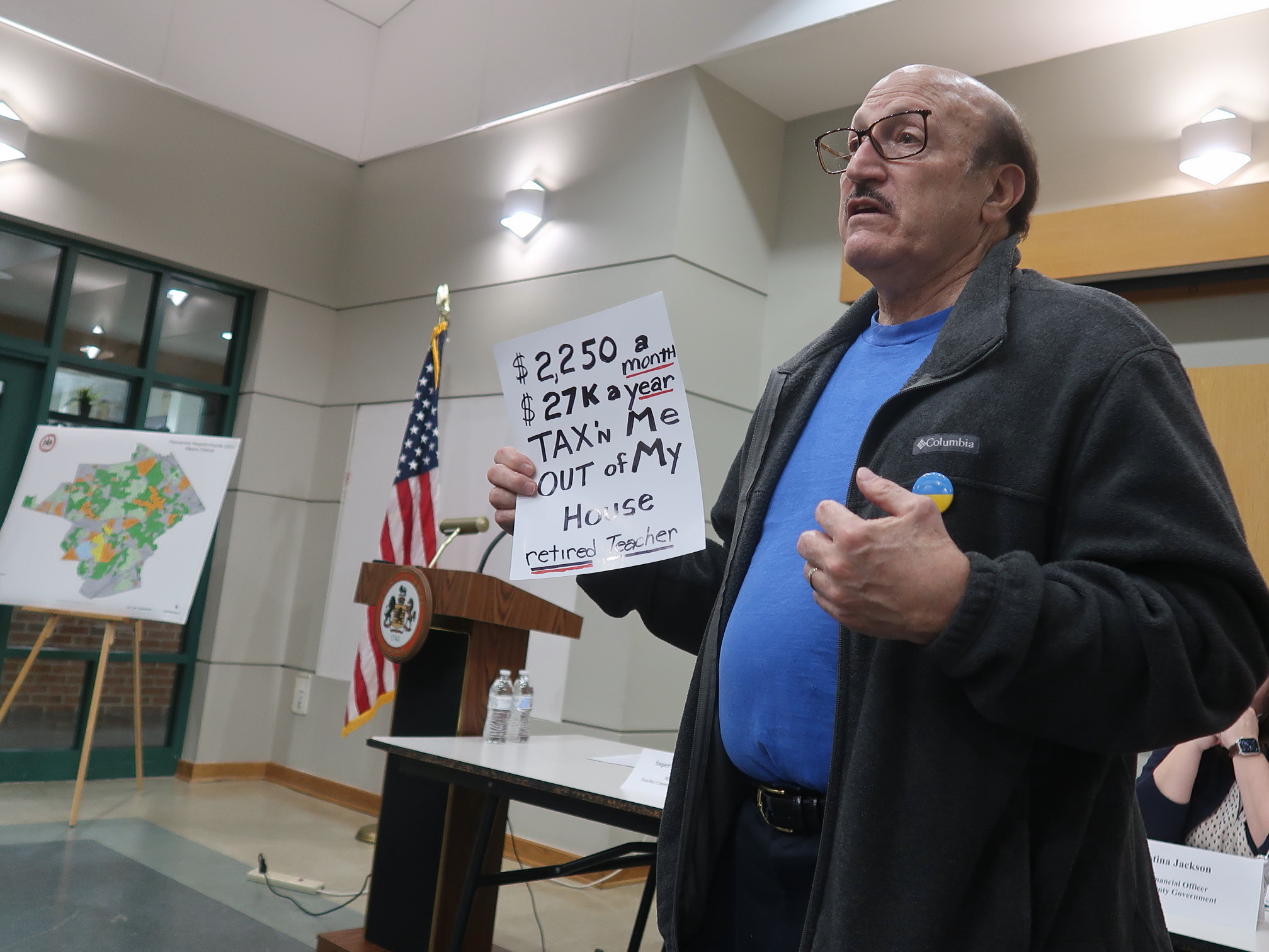

Mason District residents complain about rising assessments at budget town hall

Mason District residents complained about soaring real estate assessments at Mason Supervisor Penny Gross’ Budget Town Hall on March 9. While the county’s budget proposal for FY 2024 says the average property tax bill would increase by about $520 from last year, some Mason residents are seeing an increase of $1,000 or more. Real estate … Continued

County executive proposes a $5 billion budget for FY 2024

Fairfax County Executive Bryan Hill presented a proposed FY 2024 budget to the Board of Supervisors Feb. 21 that would retain the existing property tax rate of $1.11 per $100 of assessed value. Due to rising assessments based on equalization, however, the average annual tax bill is estimated to increase by just over $520. The … Continued

Real estate assessments rise again

Fairfax County real estate assessments for 2023 are up an average of 6.79 percent, the Department of Tax Administration announced on Feb. 21. More than 357,000 updated 2023 assessment notices are being mailed to all property owners. You can also look up your assessment here. Due to rising property values, the average annual tax bill … Continued

BoS cuts taxes for surviving spouses of military members who died in combat

The Fairfax County Board of Supervisors on Jan. 24 voted to reduce the real estate tax rate for the surviving spouses of members of the armed forces who die in the line of duty. The new tax rate for eligible military widows and widowers is one cent per $100 of assessed value. This rate is … Continued

Del. Watts to focus on climate and taxes

Longtime House of Delegates member Vivian Watts (D) is reaching out to new constituents. Due to redistricting, three Annandale area precincts – St. Albans, Masonville, and Woodburn – have been transferred from Del. Kaye Kory’s district to the newly named 14th District represented by Watts. Since she was first elected to the General Assembly in … Continued

State tax on groceries eliminated

As of Jan. 1, Virginian’s grocery costs were slightly reduced, as the elimination of the 1.5 percent state sales tax on groceries took effect. Localities are still collecting a 1 percent tax on groceries, however. The grocery tax cut will reduce state revenue by some $7 million – a small portion of the roughly $4.9 … Continued

Plastic bag tax to generate $1.2 million

Fairfax County’s plastic bag tax has raised more than $500,000 for the county in the first quarter of 2022 and is on track to generate more than $1.2 million by the end of the year. That’s the estimate in a memo from the Office of Environmental and Energy Coordination to the Board of Supervisors. The … Continued

Board cuts tax rate by 3 cents

Fairfax County Board of Supervisors approved a marked-up budget for fiscal year 2023 that cuts the property tax rate by 3 cents from the county executive’s initial proposal. Under the budget markup, the tax rate would be $1.11 per $100 of assessed value. However, due to rising home values, the average taxpayer bill would see … Continued

Another sticker shock – soaring personal property taxes

Faced with “unprecedented increases” in personal property taxes, Fairfax County Executive Bryan Hill has proposed lowering the assessment ratio for the 2022 tax year. Mason Supervisor Penny Gross discussed that issue, along with other highlights of the advertised budget for FY 2023 at a community meeting March 10. “Most vehicles typically depreciate annually,” Hill wrote … Continued

Free tax help available in Mason District

Need some help with your taxes? The AARP Foundation Tax-Aide program is in full swing at the Mason Government Center. This year, Tax-Aide volunteers are providing free tax help by appointment only. Walk-ins won’t be served. The service is free. Taxpayers must obtain an information packet before calling for their appointment. The information packet can … Continued

McKay vows to reduce property tax rate

Acknowledging the burden of skyrocketing real estate assessments, Jeffrey McKay, chair of the Fairfax County Board of Supervisors, told the community Feb. 25, “I will be strongly supporting reducing the tax rate to offset some of this impact.” Assessments for 2022 are up an average of 9.57 percent across the county compared to last year, … Continued

Real estate assessments are way up

Due to rising real estate prices, property tax assessments in Fairfax County are up an average of 9.57 percent for 2022. The average assessment for all homes is $668,974, a big increase from $610,545 in 2021, the Department of Tax Administration (DTA) reports. The 2023 advertised budget proposal presented by County Executive Bryan Hill to … Continued

Free tax help available in Annandale

Free tax preparation assistance is available in Annandale for households that earned less than $58,000 in 2021. The service is provided through the Internal Revenue Service’s Volunteer Income Tax Assistance (VITA) program. VITA is aimed at helping families maximize their tax returns and avoid the fees businesses charge to prepare taxes. VITA is available at … Continued

Youngkin pursues right-wing agenda

Virginia Gov. Glenn Younkin’s legislative priorities call for diverting funds from public schools to charter schools, banning critical race theory, restricting voting, and promoting massive tax cuts. The following bills and budget amendments introduced in the General Assembly are part of Youngkin’s “Day One Agenda.” Education The Board of Education or a local school board … Continued

Fairfax County taxes plastic bags

A new 5-cent tax on plastic bags in Fairfax County took effect Jan. 1. The Board of Supervisors approved the tax in September. The tax applies to disposable plastic bags from grocery stores, convenience stores, and drug stores.